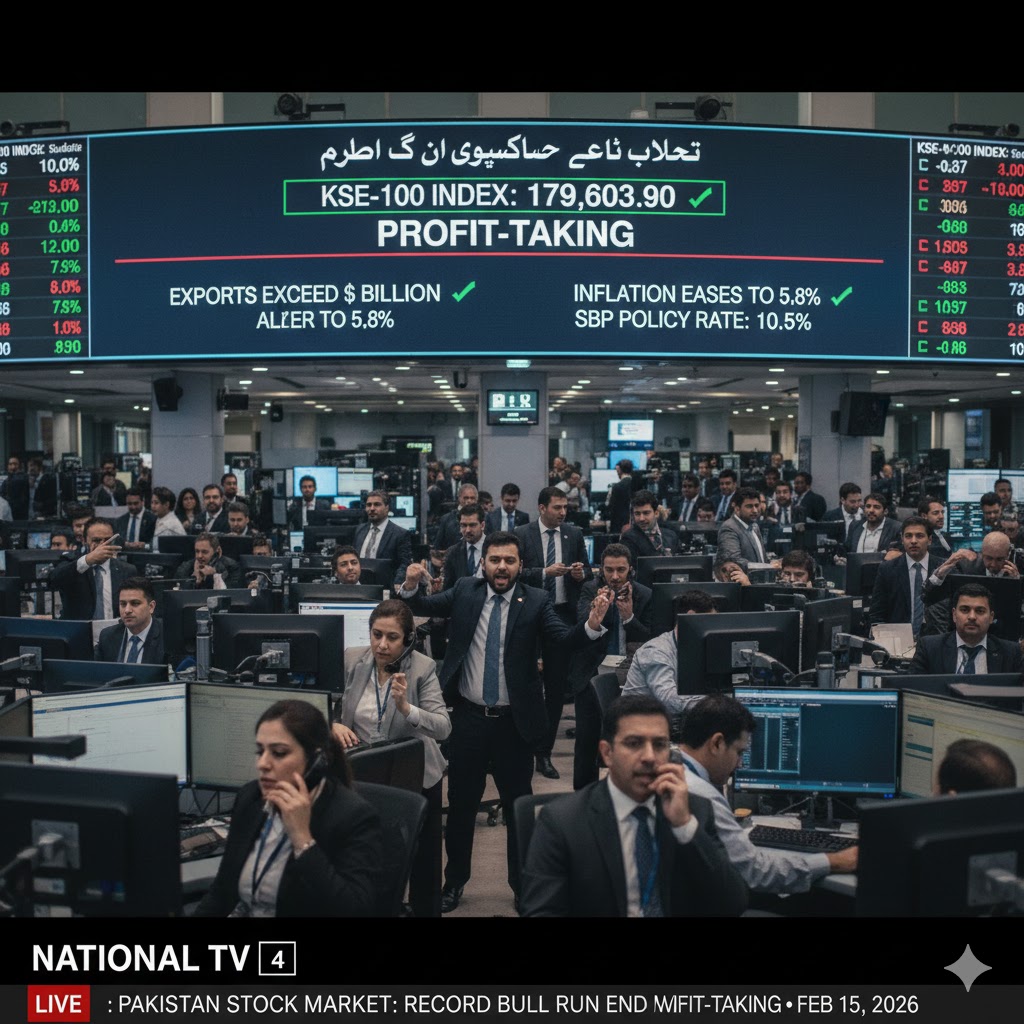

1. Stock Market: Record Highs & Profit Taking

The Pakistan Stock Exchange (PSX) continues its bull run but saw a slight correction over the weekend.

- KSE-100 Index: Closed at 179,603 points on Friday, Feb 13, after hitting an all-time intraday high earlier this year. The market shed about 900 points in the final session as investors engaged in profit-taking at record levels.

- Annual Growth: The index has shown a staggering 60.2% growth over the last 12 months, driven by improved macroeconomic stability and lower interest rates.

2. Currency & Remittances

- Dollar Sales: Sales of US dollars by exchange companies fell by 12% in the first seven months of FY26. This is attributed to stricter regulations and a shift toward banking channels.

- Remittances: Inflows through official banking channels increased by 11.3% during the same period.

- Exchange Rate: The PKR remains relatively stable, trading around 279-280 against the USD.

3. Inflation & Interest Rates

The State Bank of Pakistan (SBP) has shared an optimistic outlook for the rest of the year.

- CPI Inflation: Eased to 5.8% in January 2026, though weekly short-term inflation (SPI) showed a slight uptick of 4.26% due to food price volatility (pulses and meat).

- Policy Rate: The benchmark interest rate currently stands at 10.5%. The SBP has slashed rates by a total of 1,150 bps since June 2024 to stimulate private sector growth.

4. Trade & Industry

- Export Milestone: For the first time, monthly exports exceeded $3 billion in January 2026, led by a strong recovery in the textile and value-added sectors.

- Industrial Recovery: Large-Scale Manufacturing (LSM) recorded a 6.0% growth in the first half of the fiscal year, with automobiles and non-metallic minerals leading the rebound.

- Trade Deficit: The deficit narrowed by approximately 28% as import substitution and export-focused strategies took effect.